If a Product Launches in Distribution and No One Notices, Did It Even Happen?

Your R&D team spent years perfecting the product. Operations nailed production. Sales secured distribution.

And yet… the launch stalls.

Sound familiar? You’re not alone.

Our NPI Benchmarking Study reveals a harsh reality: Only 1 in 4 new industrial products hits its revenue targets in the first year. Even more concerning? Only 10% of manufacturers believe they outperform competitors in new product introduction capabilities.

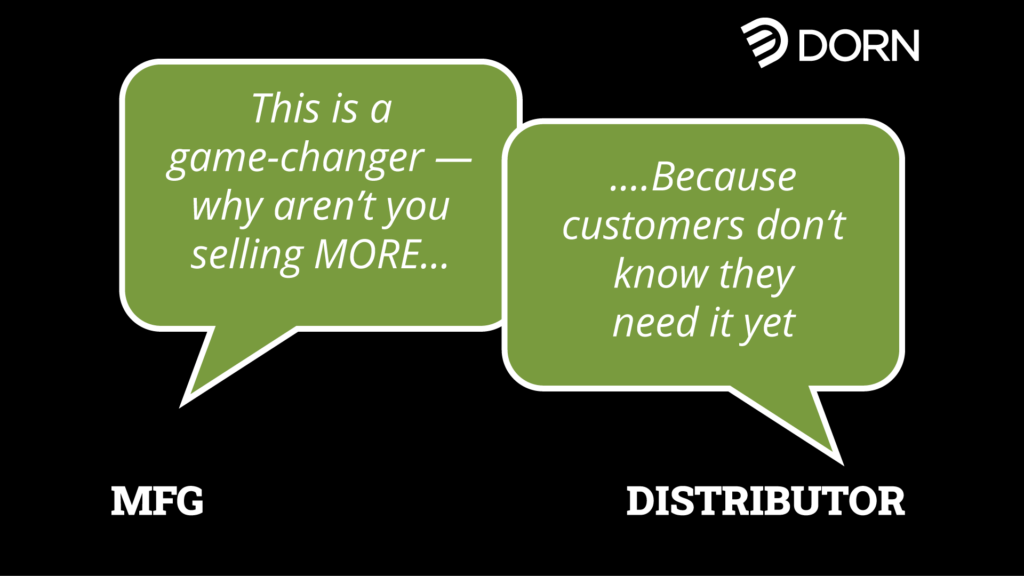

Too often, manufacturers assume that getting into distribution means the product will sell itself. But in today’s competitive landscape, availability isn’t enough—without a strategic commercialization approach, even the best products can get lost in the noise.

So what separates successful product launches from those that stall?

After analyzing hundreds of launches and directly supporting thousands, we’ve identified six proven strategies that maximize ROI, accelerate adoption, and ensure distributors don’t just stock your product—they actively sell it.

Even implementing just one or two of these strategies can create a significant impact. Let’s dive in.

6 Strategies Top Manufacturers Use to Maximize New Product ROI

1. They Tier Their Product Launches

WHAT THEY DO:

- Categorize launches into three distinct tiers:

- Level 1: Transformational, new-to-market innovations requiring comprehensive support

- Level 2: Significant improvements needing targeted commercialization

- Level 3: Line extensions and assortment fills requiring minimal launch support

- Allocate commercialization resources accordingly—ensuring the right level of sales, marketing, and distributor engagement based on the product’s complexity and market impact

- Customize sales enablement tools for each tier—so distributors and customers quickly understand the value of the product

SELF-CHECK: Are you treating every new product launch the same, or do you have a tiered strategy that ensures the right level of support for each introduction?

2. They Create Dedicated Product Adoption Teams

WHAT THEY DO:

- Form cross-functional teams (product, marketing, sales, technical support) that stay with products throughout the critical 3- to 5-year NPI lifespan

- Extend Stage-Gate thinking beyond development—ensuring commercialization and adoption get the same level of strategic focus as R&D

- Implement structured market testing to refine messaging, pricing, and value propositions based on real-world customer feedback

- Track leading indicators of adoption (not just sales numbers) to identify and address potential roadblocks early

- Collaborate with distributors on joint sales calls to provide real-world product demonstrations and build confidence in selling the solution

SELF-CHECK: Do your product teams move on immediately after launch, or do you have dedicated resources driving adoption throughout the full NPI lifecycle?

3. They Engineer Demand, Not Just Hope for It

WHAT THEY DO:

- Proactively generate demand at the end-user level rather than waiting for distributors to take the lead

- Secure product specifications early in the decision-making process by collaborating with key stakeholders across the value chain (engineers, OEMs, architects, and safety professionals) to ensure your solution is embedded into projects before procurement begins

- Develop application-specific proof points—leveraging case studies, third-party validation, and real-world ROI metrics to move beyond feature-driven selling and into business-impact storytelling

- Align marketing and sales efforts to sustain demand momentum post-launch, ensuring continued engagement beyond the initial hype cycle

SELF-CHECK: Are you driving end-user demand intentionally and strategically, or just assuming distributors will make your product a priority?

4. They Target High-Impact Distributor Resources—Not Just Any

WHAT THEY DO:

- Prioritize the distributor teams that have the most direct influence on adoption. According to our NPI Benchmarking Study, the most impactful resources are:

-

- Distributor field sales teams—the #1 driver of customer adoption

- eCommerce & digital selling teams—a growing force in influencing purchasing decisions

- Inside sales teams—critical for reinforcing adoption through direct customer engagement

- Align marketing, sales enablement, and training efforts around these key resources instead of taking a broad, one-size-fits-all approach

- Equip distributor field sales teams with high-impact selling tools that highlight differentiation and value—not just product specs

- Ensure digital channels are fully optimized, with strong product positioning, application content, and conversion-focused strategies

SELF-CHECK: Are you investing in the right distributor resources, or spreading efforts too thin across teams with lower influence on adoption?

5. They Shift Budget to Commercialization—Because Innovation Alone Isn’t Enough

WHAT THEY DO:

- Rebalance investment toward commercialization to drive market adoption. Years ago, manufacturers could rely on distributors to push new products with minimal effort. But today? Market saturation, faster innovation cycles, and shifting buyer expectations mean new products don’t just sell themselves. Our NPI Benchmarking Study reveals that while manufacturers allocate 75% of their budget to R&D and production, only 25% goes to commercialization—leaving too many new products unsupported after launch

- Extend Stage-Gate thinking beyond development to ensure long-term market success. The old playbook—develop, launch, move on—doesn’t work anymore. Winning manufacturers fund post-launch initiatives just as aggressively as R&D, including distributor training, targeted demand generation, and sales enablement

- Invest in sustained adoption initiatives instead of front-loading launch budgets. Instead of a one-time marketing push, they dedicate budget to multi-phase commercialization efforts that evolve based on real-time feedback from customers and distributors

SELF-CHECK: Are you still following an outdated launch playbook, or are you adapting to today’s market realities?

6. They Equip Distributors to Sell with Confidence

WHAT THEY DO:

- Provide sales tools designed for how distributors actually sell. The most effective manufacturers go beyond basic product brochures—they offer application-driven sales playbooks, clear value messaging, and digital assets that seamlessly integrate into distributor workflows

- Create easy-to-activate marketing campaigns. Instead of expecting distributors to build their own materials from scratch, they develop co-branded, ready-to-use campaigns that distributors can quickly deploy across their own sales and marketing channels

- Structure incentives that drive engagement, not just transactions. The best manufacturers reward distributor sales teams for product adoption milestones, training participation, and stocking commitments—ensuring long-term success, not just initial buys

- Support distributor teams with meaningful training. Successful manufacturers provide ongoing, practical education through interactive training, field sales collaboration, and reinforcement tools that make product knowledge stick

SELF-CHECK: Are you making it as easy as possible for distributors to understand, position, and sell your product with confidence?

The Results Speak for Themselves

Manufacturers who implement these strategies see dramatic improvements:

Case in Point: A Global Manufacturer’s Turnaround

A global manufacturer faced a critical challenge: a technically superior product had failed to gain traction despite a previous launch. The product wasn’t the problem—the approach was.

We guided their strategic approach to relaunch:

- Shifted from product-focused selling to solution-based selling that addressed real customer pain points

- Implemented a dual-track strategy that built end-user demand while enabling distributors

- Positioned the product as a category-defining solution rather than just an alternative to traditional options

The impact?

- 6X revenue target achievement in year one

- Accelerated adoption across multiple segments

- Established a foundation for majority market share conversion over the next five years

- Transformed the product into a category leader

This success story highlights how a strong commercialization strategy can turn a stalled product into a market leader.

Other Manufacturers See Similar Gains:

- Time to profitability shrinks (from 18 months → 7 months)

- New product vitality scores jump (average 27% increase)

- Distributor engagement improves, leading to higher sell-through rates

Taking Action: Your Next Steps

- Assess your current approach against the six strategies above

- Identify your biggest gap—is it distributor engagement, budget allocation, or lack of end-user pull?

- Take immediate action on at least one strategy in the next 30 days

Q: What’s been your experience with new product launches?

What’s one commercialization strategy that has made the biggest impact for your organization?

Drop a comment below or send me a message—I’d love to hear your thoughts.

Want a copy of our complete NPI Benchmarking Study? Download it now >>